Weekly Notebooks - Week 41

A brief note on my thoughts and important levels going into next week

Hi friends, thank you for the support and feedback, and I hope you enjoy the notebooks for this week!!

If you missed my monthly notebooks you can find them here:

Monthly Notebook - A brief note on my longer-term thoughts and important levels going into next month

The Monthly 30’s - A brief note on my thoughts and important levels for the top 30 stocks in the NASDAQ & the Dow Jones Industrial

Download Notebook: https://bit.ly/33oFu3W

Inside this notebook, you will find a short-term summary of my analysis of the top US indices and US sectors using technical analysis.

My observations from this week:

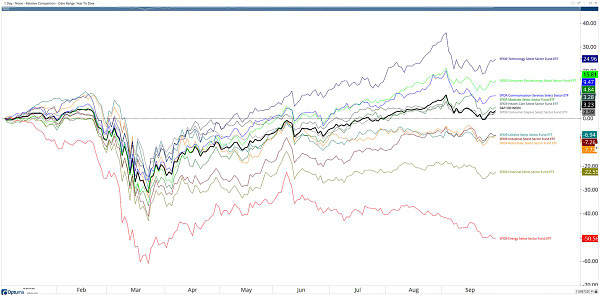

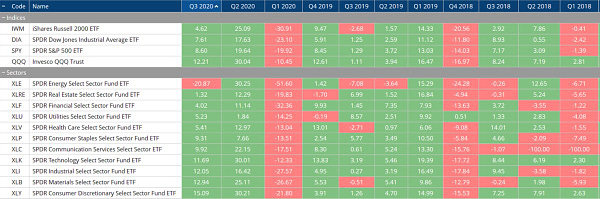

Consumer Discretionary sector on a relative basis is ripping higher, and it also had a good week gaining 3.02%. I’ll say it once again, as long as prices are above 133 on a daily closing basis, then this breakout is intact, and it can look for further upside.

Utilities were up 3.35% this week. I will be watching for a continued hold and move upwards from the 60.50 level. If it can hold above this level, it will be hard to be bearish. This level also coincides with the 61.8% Fib level and its 200-day moving average.

Energy with another week as the weakest sector dropping 2.88%. Energy has continued its move lower since breaking below its support level, the probability of a retest of its 2020 lows is getting higher and higher by the week.

Other fun facts:

9 of 11 sectors are above their 200-day moving average.

On average, the 11 sectors are 0.19% Month to Date.

On average, the 11 sectors are -2.55% Year to Date.

On average the 11 sectors are 15.46% from their all-time highs.

On average the 11 sectors are 13.82% from their 52-week highs.

Only 6 of 11 sectors are above their 2019 highs.

Only one sector is still below its 2018 lows. Can you guess who? Ha! energy! Ha!

If you have any questions about this notebook, please feel free to contact me on twitter: @granthawkridge

Download Notebook: https://bit.ly/33oFu3W

Download MM Notebook: https://bit.ly/33snENL

Inside this notebook, you will find my significant price levels which in turn provides a base for my bullish, neutral or bearish thesis on the markets for the short-term future. It is worth mentioning these levels are subject to change when the price or any other data changes.

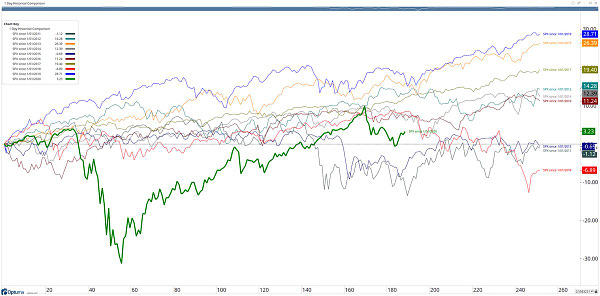

Bottom line: Time to switch again... for now I am now bullish on the market... I said last week, “it wouldn’t need much pushing to get back to being bullish on the market” I follow the data and price not my feelings:

Bullish: 11

Neutral: 10

Bearish: 2

It is worth mentioning again these levels are subject to change when the price/data changes... so yes, tomorrow they might be different!

So, if you have a different thesis for the market, please share your ideas in the comment section or get in contact with me on Twitter: @granthawkridge. The stock market always has two sides to the story… buyers and sellers, and it’s okay to switch between the two when the price/data changes.

Download MM Notebook: https://bit.ly/33snENL

Some other charts I posted during the week:

Stay safe and good luck out there…

GH

P.s. These notebooks I share are a work in progress, so if you have any questions or feedback, please feel free to contact me on Twitter: @granthawkridge

P.p.s. I have purchased a microphone, so I will begin working on the weekly market rundown video finally!!!!

DISCLAIMER: The information included in this report are obtained from sources which Jotting on Charts believes to be reliable, but we do not guarantee its accuracy. All of the information contained herein should be independently verified and confirmed. All opinions expressed by Jotting on Charts are for informational purposes only. Jotting on Charts is not a financial advisor, and this does not constitute investment advice nor any opinions expressed, constitute a solicitation of the purchase or sale of any securities or related financial instruments. Jotting on Charts is not responsible for any losses incurred from any use of this information. Do not trade with money you cannot afford to lose. It is recommended that you consult a qualified financial advisor before making any investment decisions.